Mold is a common problem in homes, and it can cause significant damage when left untreated. If you discover mold in your home, you should take action immediately to prevent it from spreading and causing more damage. However, filing an insurance claim for mold damage is not as straight forward as filing a claim involving another cause of loss. The impact mold will have on your property insurance claim can vary, depending on several factors. In this blog post, we’ll explore the impact of mold damage on your home insurance claim.

Coverage for Mold Damage

Homeowner’s insurance policies typically cover mold damage caused by a covered peril, such as water damage resulting from a burst pipe or a sudden and accidental discharge of water from a household appliance. However, coverage for mold damage may be limited or excluded in some policies. To know for sure, you should review your policy or have a policy expert (such as a Public Adjuster or Property Insurance Attorney) review your policy for you so that you are clear on your coverages and exclusions.

Need A Policy Review? Text REVIEW to 800-884-3638

Mold Discovery During Insurance Claim

The impact of mold damage on your home insurance claim depends on several factors, including the cause of the damage, the extent of the damage, and your insurance policy’s terms and conditions. Here are some potential scenarios:

Possible Causes of Structural Mold:

- Constructive techniques that result in trapping of moisture

- Improper flashing; ice damming; inadequate heating, ventilation, and air conditioning (HVAC) systems

- Poorly graded lots

- Improperly installed stucco or other cladding

Structural mold is often hidden in:

The Institutes, Water Losses and Mold Claims

- Concrete, Brickwork, Wall cavities, Crawl spaces, Attics

Development of Mold:

- Structure remains wet for an extended period

- Microbial growth begins

- Microorganisms feed on organic materials in structure

- Levels of toxic chemical substances, volatile organic compounds, odors, and organic debris escalate

- Structural components begin to lose integrity

- Visible damage (staining) occurs

Mold Resulting from a Covered Peril

If the mold damage is the result of a covered peril, such as water damage from a burst pipe, your home insurance policy should cover the cost of the mold remediation, subject to your policy’s limits and deductibles.

Here area a few common causes of mold.

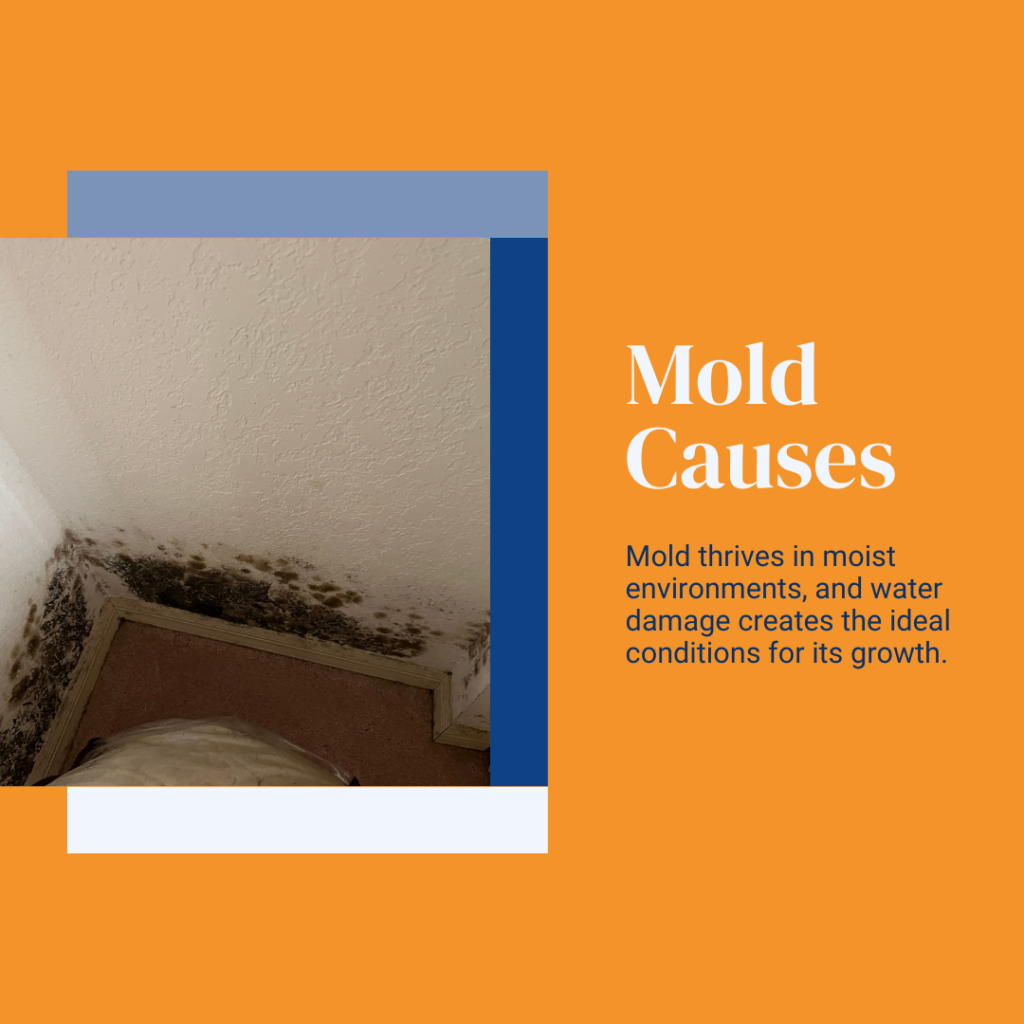

Scenario 1: Mold After Water Damage

Situation: You’ve experienced water damage due to a burst pipe, roof leak, or flooding. Shortly after the incident, you discover mold growth in affected areas.

Insight: Mold thrives in moist environments, and water damage creates the ideal conditions for its growth. Document the extent of the mold growth and water damage through photos and videos, whether it is found in the ceiling, walls, or floor of your property. Notify your insurance company about the mold discovery and the underlying cause (e.g., water damage).

Scenario 2: Pre-existing Mold

Situation: During a property inspection or routine maintenance, you discover pre-existing mold that you were unaware of before.

Insight: Pre-existing mold is very often excluded from coverage. If the mold growth is a result of a covered peril, such as a sudden pipe burst, you actually may have a viable property insurance claim. Consult

Scenario 3: Delayed Mold Discovery

Situation: You’ve had a past incident, such as a roof leak or plumbing issue, which was resolved, but you discover mold growth months later.

Insight: Delayed mold discovery can be challenging because it’s difficult to establish a direct link between the initial incident and the subsequent mold growth. Insurance companies might question the cause-and-effect relationship, leading to potential coverage disputes.

Scenario 4: Limited Mold Coverage

Situation: You have mold coverage as part of your policy, but there are limitations on the extent of coverage.

Insight: Many insurance policies include mold coverage, but there are often limits on the amount covered or specific circumstances under which mold-related expenses are reimbursed. Read your policy carefully to understand the extent of your mold coverage.

Mold Resulting from Neglect

If the mold damage is the result of neglect, such as failing to repair a leaky roof or properly ventilate a bathroom, that mold damage will most likely not be covered. In fact, most of the homeowner’s insurance policies exclude coverage for mold damage resulting from long-term neglect.

Limited Coverage for Mold Damage

Certain insurance policies may provide limited coverage for mold damage, whether it be a separate sublimit or deductible for mold remediation. This means that your insurance company will pay up to the limit specified in your policy for mold remediation, or a separate deductible will be applied. Other insurance policies may exclude coverage for mold damage altogether.

What to Do If You Discover Mold in Your Home

If you discover mold in your home, it’s essential to take action immediately to prevent it from spreading and causing more damage. If you are trying to decide whether to file a claim, it’s important that you get to the bottom of what is actually causing the mold. In terms of the “ideal” claim, there will have been a recent, sudden and accidental discharge of water (such as from an air conditioning unit or plumbing system) event. Other than that, here are some steps you can take:

- Identify the source of the moisture and fix it.

- Hire a professional mold remediation company to assess the extent of the damage and develop a remediation plan.

- Contact your insurance company to report the mold damage and file a claim if necessary.

The impact of mold damage on your home insurance claim can vary depending on several factors. It’s essential to review your insurance policy carefully to understand your coverage limits, deductibles, and exclusions. If you discover mold in your home, take action immediately to prevent it from spreading and causing more damage.