Flood insurance is a unique type of insurance, and in the event of a claim needing to be filed, it is important that you understand your coverages correctly. In this blog, we will talk about the basics of flood insurance policies and what is usually covered.

What flood insurance covers

If you ever sustain damages due to a flooding event, the purchased National Flood Insurance Program (NFIP) policy covers direct physical losses to your structure and belongings.

What does my policy cover?

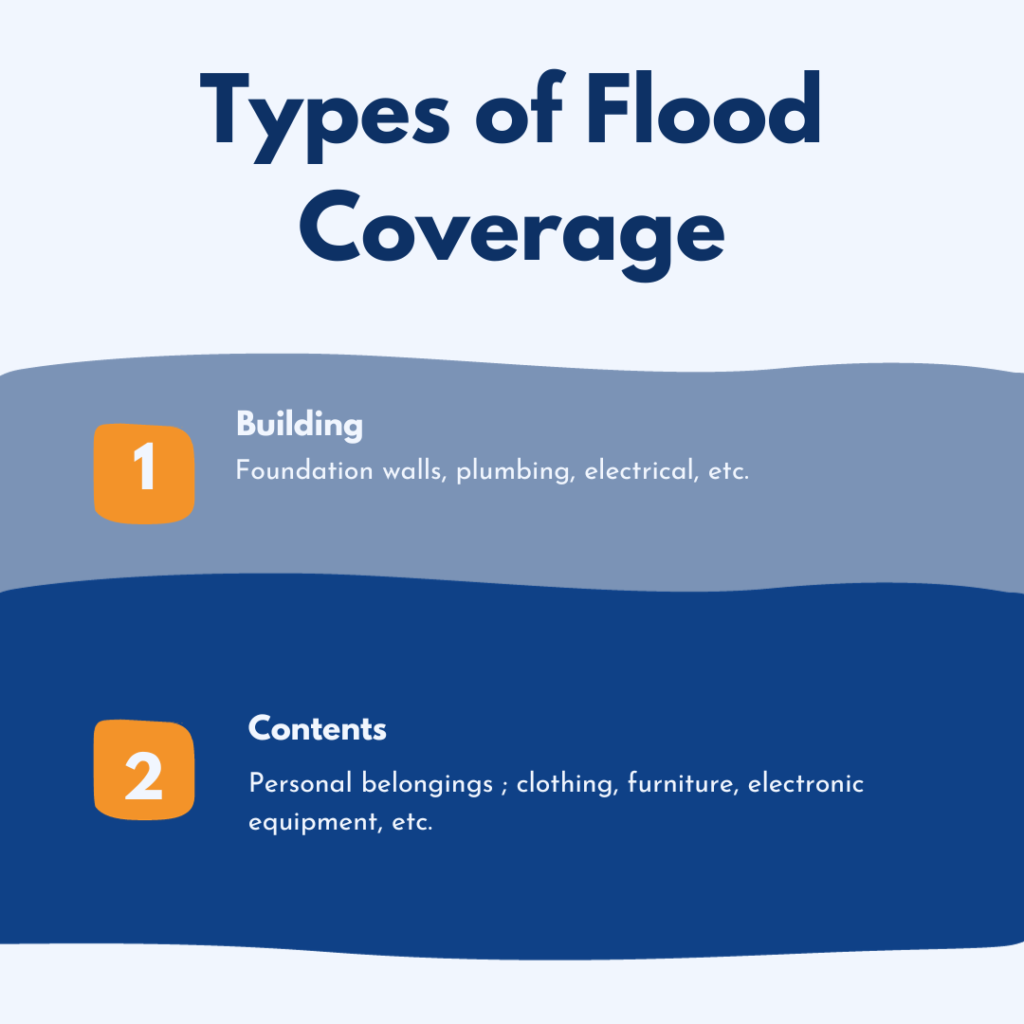

The point of flood insurance is to help protect the things you value from covered losses. Flood insurance coverage comes in two forms – building coverage and contents coverage.

Here are some examples of what property is covered under NFIP flood insurance:

Building coverage protects your:

- Electrical and plumbing systems

- Furnaces and water heaters

- Refrigerators, cooking stoves, and built-in appliances like dishwashers

- Permanently installed carpeting

- Permanently installed cabinets, paneling, and bookcases

- Window blinds

- Foundation walls, anchorage systems, and staircases.

- Detached garages

- Fuel tanks, well water tanks and pumps, and solar energy equipment

Contents coverage protects your:

- Personal belongings such as clothing, furniture, and electronic equipment

- Curtains

- Washer and dryer

- Portable and window air conditioners

- Microwave oven

- Carpets not included in building coverage (e.g., carpet installed over wood floors)

- Valuable items such as original artwork and furs (up to $2,500)

What isn’t covered by flood insurance?

When determining coverage, the cause of flooding matters.

Flood insurance covers losses directly caused by flooding. In the most basic of definitions, “flood” refers to an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties.

For example, damage caused by a sewer backup is covered if the backup is a direct result of flooding. If the sewer backup is not caused directly by flooding, the damage is not covered.

- Items not covered by building or contents coverage:

- Temporary housing and additional living expenses incurred while the building is being repaired or is unable to be occupied

- Property outside of an insured building. For example, landscaping, wells, septic systems, decks and patios, fences, seawalls, hot tubs, and swimming pools

- Financial losses caused by business interruption

- Currency, precious metals, stock certificates and other valuable papers

- Cars and most self-propelled vehicles, including their parts

- Personal property kept in basements

Types of flood insurance

The NFIP partners with more than 50 insurance companies and thousands of independent agents across the country to offer the same affordable NFIP rates and crucial insurance coverage.

What is covered under a flood insurance policy?

This will depend on the type of insured category that you fall into. To get a clear understanding, first identify which of the following best describes you:

Property Owner Flood Insurance Coverages:

If you own your home – including condominiums and townhouses – the NFIP offers flood insurance policies to cover your home’s structure and belongings.

- What’s covered: Your foundation, electrical and plumbing, finishings, appliances, electronics, personal belongings, and more.

- Coverage limits: $250,000 for the building and $100,000 for the building contents. These are typically purchased separately with separate deductibles.

Business Owner Flood Insurance Coverages:

If you’re a business owner, the NFIP offers commercial flood insurance policies to help protect your business’s structure and equipment.

- What’s covered: Your foundation, electrical and plumbing, finishings, equipment, furniture, inventory, and more.

- Coverage limits: $500,000 for the building and $500,000 for the building contents. These are typically purchased separately with separate deductibles.

Renter Flood Insurance Coverages:

If you’re a renter, the NFIP offers affordable, renters flood insurance to protect the things you care about in the event of a flood. Ask your landlord to be sure he/she has coverage for your building.

- What’s covered: Your furniture, clothes, television, computers, rugs, artwork, and more.

- Coverage limits: $100,000 for contents-only coverage. Starting policy costs: $99/year

It’s best to be prepared in the event of a flood event. If you ever need help after a flood, please call us directly at (800)-884-3638

Sources: Flood Smart, https://www.floodsmart.gov/whats-covered