Changes At A Glance

Everything You Need To Know About Florida Law Changes for Property Insurance

Florida Legislature Approves New Insurance Bill

Recent updates to Florida’s property insurance laws bring significant changes that could impact how you handle claims and interact with your insurance company. As a homeowner or property owner in Florida, staying informed about changes in property insurance laws is crucial to protecting your interests and ensuring you have the coverage you need when you need it most.

Let’s take a closer look at these changes.

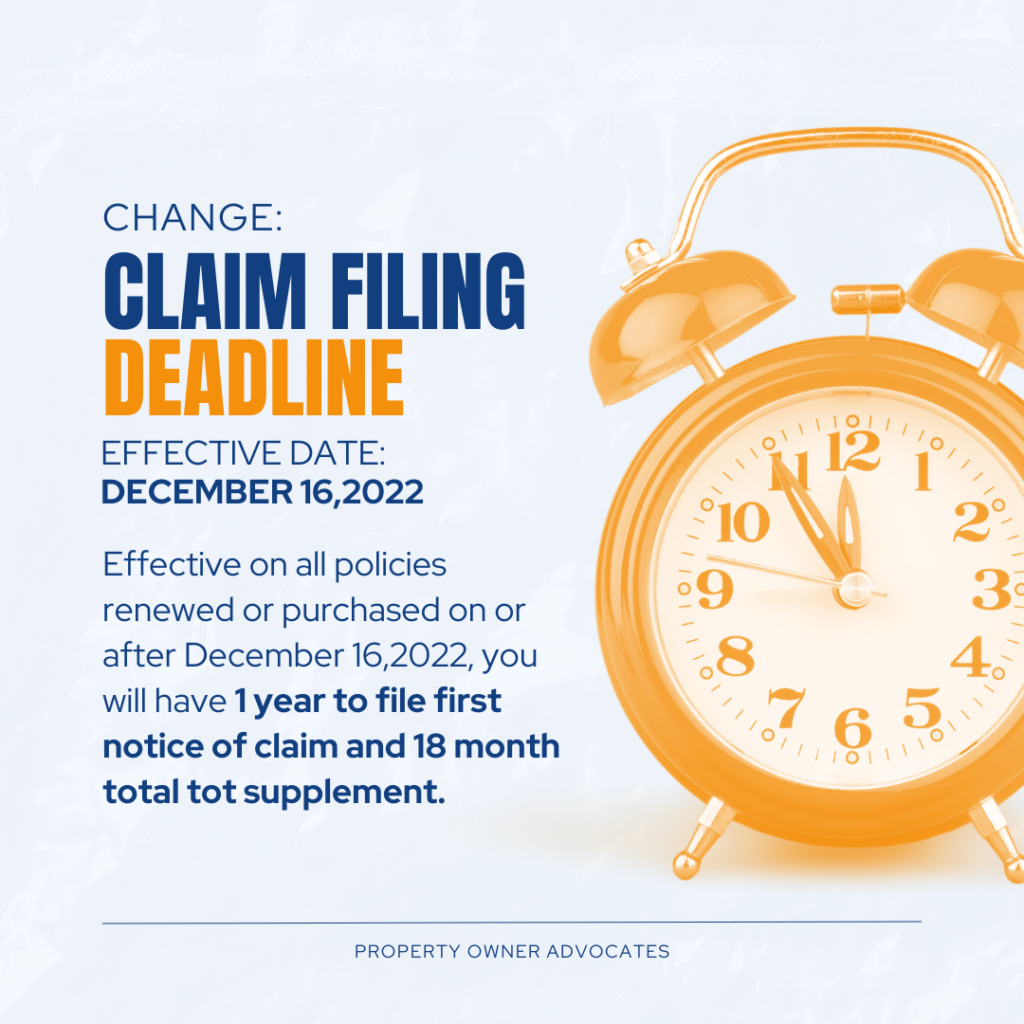

How Long You Have To File A Claim In Florida

All policies renewed or purchased after December 16, 2022, now provide policyholders with a more generous timeframe for filing claims. Policyholders have one year from the date of loss to file the first notice of claim and up to 18 months total to supplement the claim.

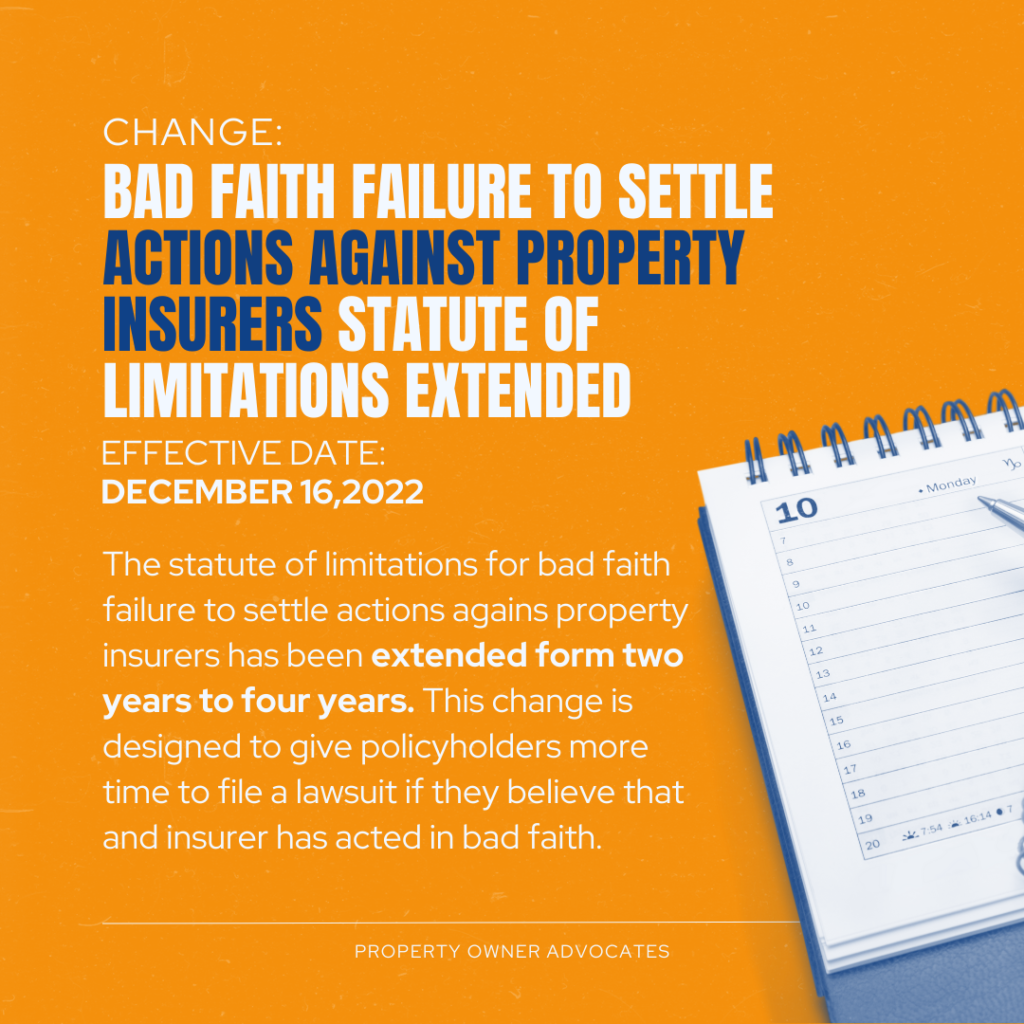

Extension of Statute of Limitations for Bad Faith Claims:

Effective December 16, 2022, the statute of limitations for bad faith claims has been extended. Policyholders now have four years from the date of loss to pursue legal action against their insurance company for bad faith practices, up from the previous two-year limit.

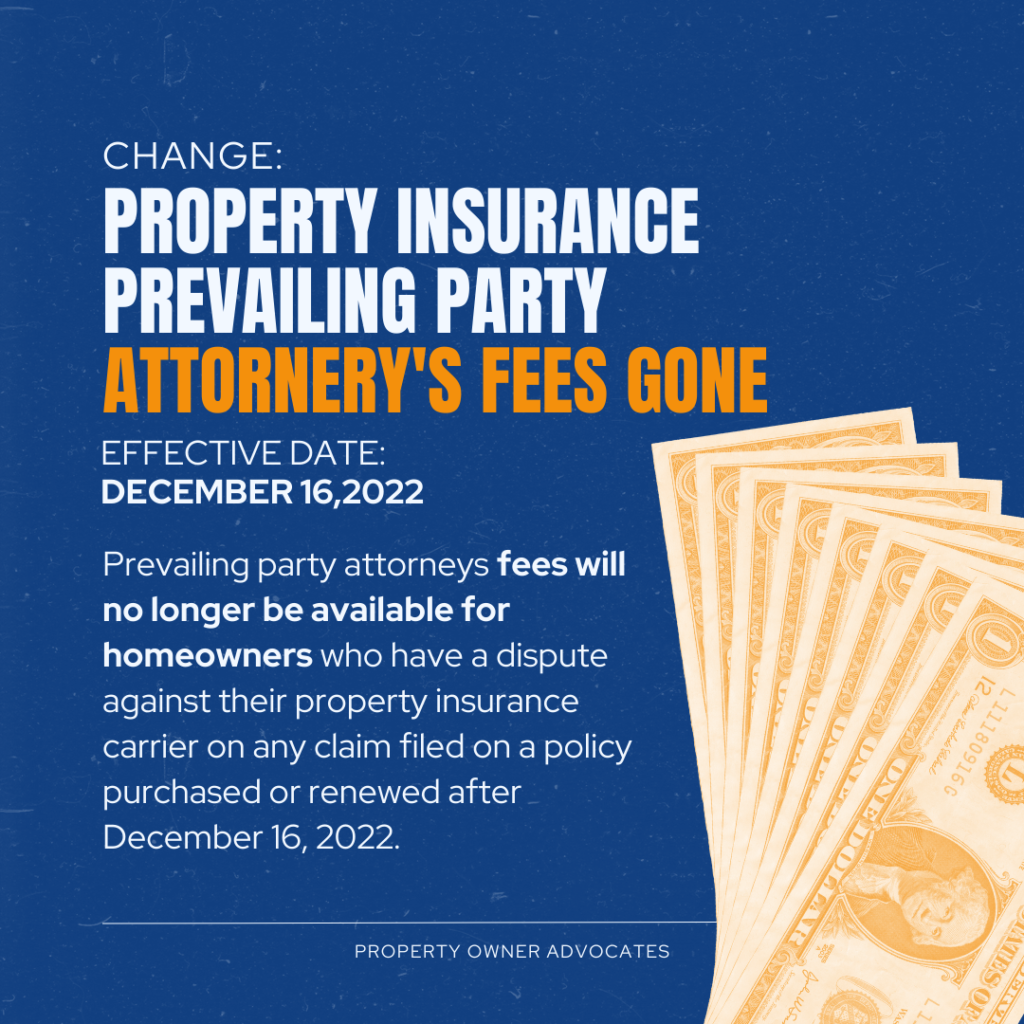

Changes to Prevailing Party Attorney Fees:

As of December 16, 2022, prevailing party attorney fees will no longer be available to policyholders for policies renewed or purchased after this date. This change could impact the financial dynamics of pursuing legal action against insurance companies.

Invalidity of Assignment of Benefits (AOB):

Assignment of benefits, a common practice in property insurance claims, is no longer valid for policies renewed or purchased after January 1, 2023. This change aims to reduce reported fraud and abuse in the assignment of benefits process.

When Does Insurance Company Have To Pay Or Deny A Claim In Florida

Effective March 1, 2023, insurance companies are required to pay or deny a claim within 60 days of receiving all required documentation from the policyholder. This provision aims to expedite the claims process and ensure policyholders receive timely responses from their insurance companies.

These changes to Florida’s property insurance laws have significant implications for homeowners and property owners navigating the insurance claims process.

For more information about your insurance policy, or claim questions, get in touch now!

Get connected with a knowledgeable public adjuster right away.

We’re here to help you understand your rights and ensure you receive fair treatment from your insurance company.