Having to deal with an insurance claim can be a complicated and frustrating process in itself. Add to that having to deal with insurance claim delays, and even Whether you are dealing with a delay due to paperwork issues, lack of communication from your insurance company, or other factors, it is important to know how to navigate the process effectively. In this blog, we will talk about the tactics that insurance companies use to delay claims and what you can do to overcome them.

Recognizing Insurance Company Delay Tactics

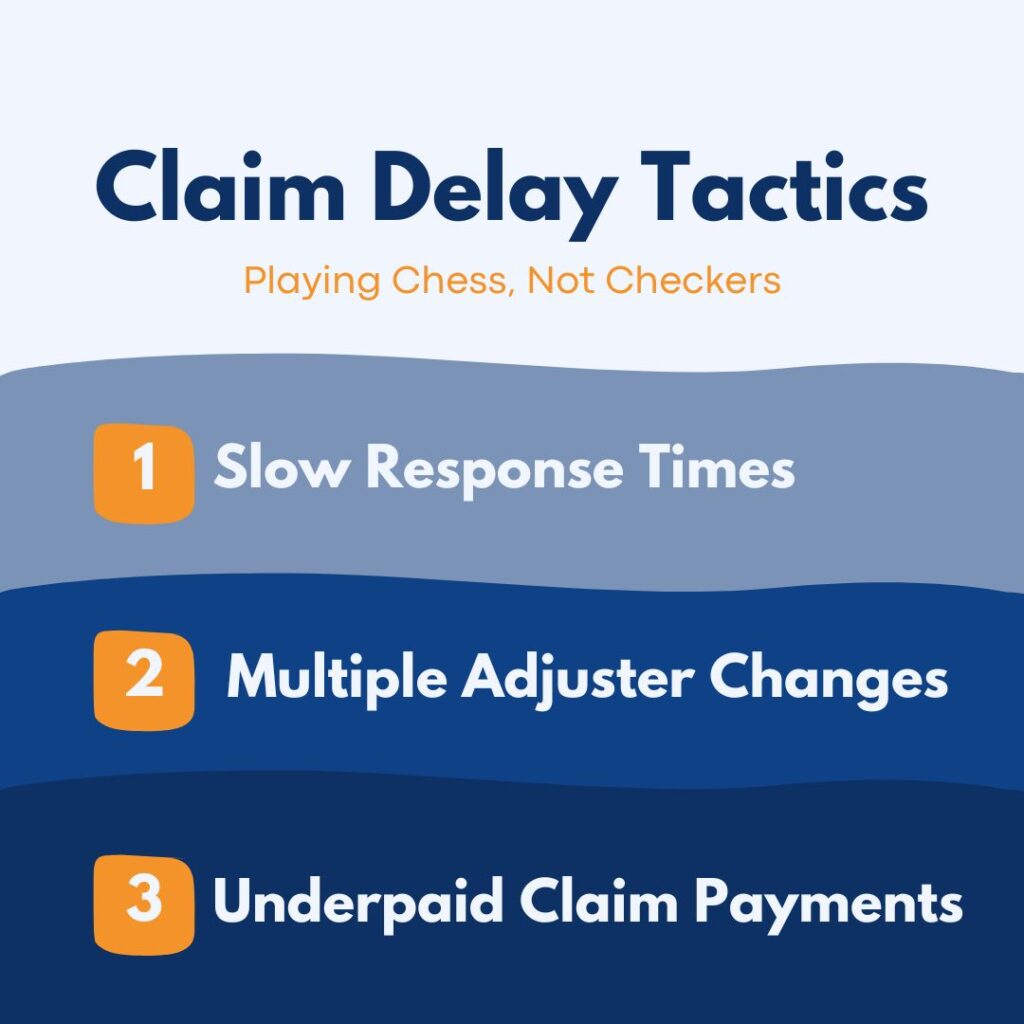

During your insurance claim, there will be a few tell-tale signs that your claim is being delayed. This isn’t an exhaustive list, but here are some of the common signs of a claim delay:

- Slow response times: in most states, statutes govern the timelines that insurance companies have with respect to communication. In Florida, an insurance carrier has up to 7 days to respond to any inquiry or request for information, up to 90 days to make a coverage determination/claim payment (which drops down to 60 days after a Sworn Proof of Loss is provided). This allowance is often used to the insurance company’s advantage in them “running out the clock”.

- Multiple Adjuster Changes: Speaking from experience, this is the most commonly used and effective tactic insurance companies use to delay their claims. In particular, frequent changes in assigned desk adjusters effectively serves as a soft reboot or reset in your claims process. Newly assigned desk adjusters will request a “few days” to review the claim file – even if the previous adjuster had already indicated that they had progressed their review past their desk and over to a supervisor for approval.

- Underpaid claim payments: It is well established case law that when a claim is filed, the insurance company will pay at the minimum the Actual Cash Value (ACV) of your claim, even if you are insured for Replacement Cost Value (RCV). This is a delay tactic in that once the insurance carrier makes a payment, regardless of the amount, they will often “close” the claim. This is not the same as a claim being settled or truly resolved, but what it effectively means is that the claim is closed with respect to the desk adjuster who was initially handling it. To request another payment, the claim needs to be reopened and a new desk adjuster needs to be assigned – see above note on the multiple adjuster changes to see how that cycle then begins.

How To Overcome Insurance Company Delay Tactics

Now that we’ve reviewed some of the signs of a delayed claim, let’s talk about some ways to show your insurance company that these tactics won’t work very well with you.

- Document Everything: Keeping notes dates, times, and the content of discussions. This documentation serves as evidence of their delay tactics. Sending your desk adjuster your notes will also show them that you are not passively going through the claim and that you have every intention of holding them accountable.

- Stay Persistent: Regularly follow up on your claim’s progress and ensure your inquiries are documented. Keep in mind the above-mentioned statutory timelines that the insurance company has to honor and make sure that they do.

- Know Your Policy: Having a good understanding of your policy and the coverages will help you to combat any disputes in coverage and avoid unnecessary delays in coverage determinations.

- Hire Representation: Whether it’s a Public Adjuster or Property Insurance attorney, you should consider having representation of your own through the claims process. Insurance companies have a network of experts and staff that help them, you can tap into that same network but for your own purposes when you hire a professional and competent policy expert.

In conclusion, dealing with insurance claim delays can be a challenging experience. If you follow this guide, it can be very manageable! As always, we’re here to help you if you need it.

Need help with your property insurance claim?